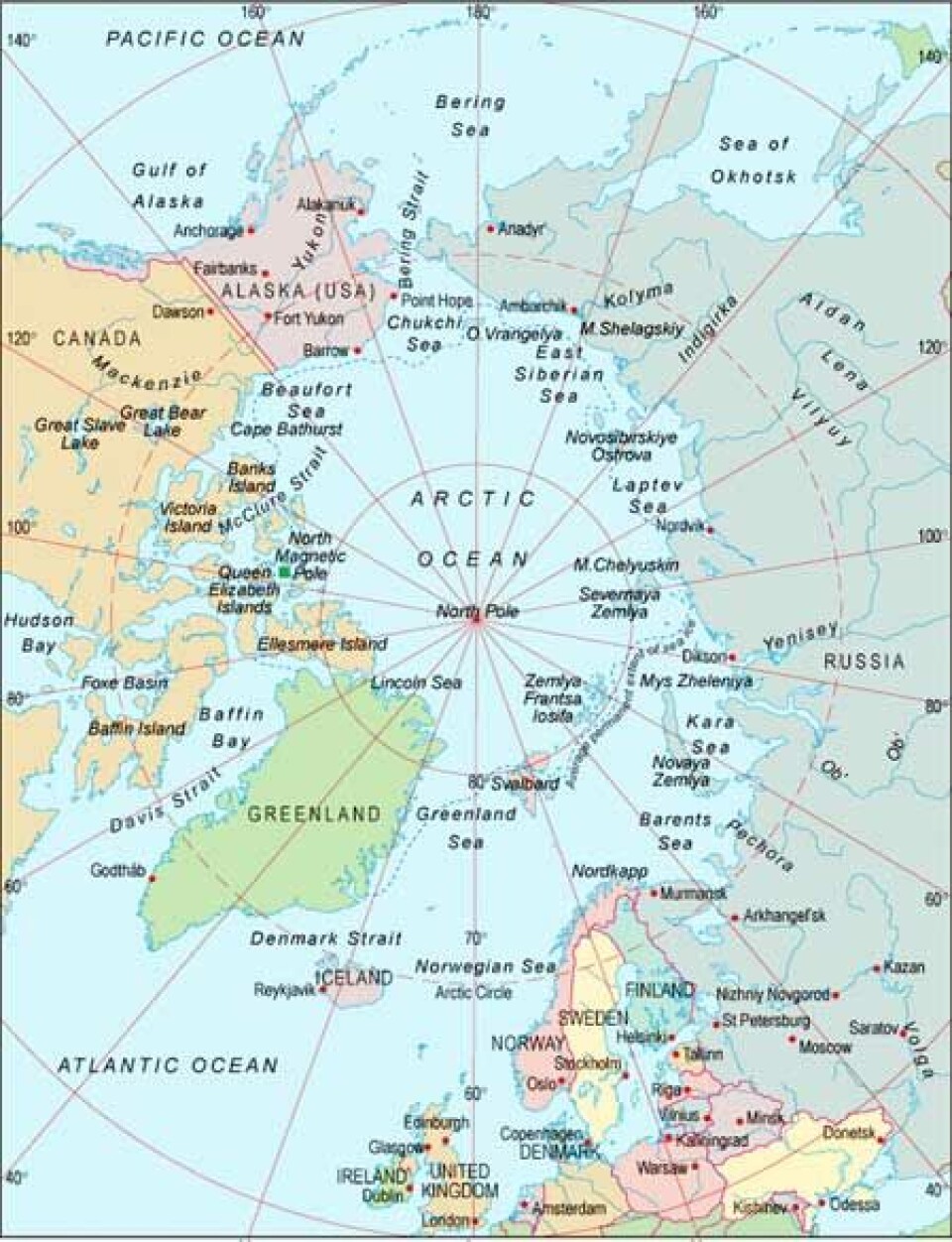

Med olje fra Russland langs norskekysten

Vi tillater oss å sitere fra forskningsrapporten“Oil transport from the Russian part of the Barents Region Status per January 2007”utarbeidet av Alexei Bambulyak and Bjørn Frantzen

Denne artikkelen er tre år eller eldre.

Fra avsnittet “Summary”:

Oil transportation from the Russian part of the Barents Region along the Norwegian coast had insignificant volumes before 2002. However, in 2002 there was a dramatic increase in oil shipment, when 4 million tons of oil was transported across the northern regions. In 2003, the volume reached 8 million tons. The trend continued in 2004, and about 12 million tons of export oil and oil products were delivered from the Russian part of the Barents Region to the western market along the Norwegian coast.

In 2005, the oil shipment volumes dropped to 9.5 million tons, and in 2006 increased to 10.5 million tons.

The terminals loading oil for export from the Russian Western Arctic seas have been continuously developed, and the overall shipping capacity has been enlarged. The changes in oil volumes carried for export through the Barents Sea during the recent two years were not so much dependent on the terminals’ capacities and logistic systems as on the external factors.

The change in the rates for cargo shipment by Russian railways, construction of the Baltic Pipeline System by Transneft and limitations on Volgotanker activities were a few examples that induced oil transport operators to develop new terminals in the Kola Bay and to focus more on oil products than crude oil.

The new year of 2007 started with a big oil export challenge that gave another impulse for developing the northern oil traffic channel in Russia. The conflict between Russia and Belarus upon oil transit to Europe via the Druzhba (Friendship) pipeline made the Russian Government and Transneft reorient the Russian oil routes. Transneft proposed to expand the capacity of the Baltic Pipeline System from 76 to 120 million tons. The Northern pipeline Kharyaga–Indiga to the Barents Sea coast can also decrease the dependence of the southern routes and neighbouring countries. However, the Northern pipeline stands after the Baltic Pipeline System, East Siberia–Pacific Ocean pipeline, and Burgas– Alexandroupolis pipeline projects in the Transneft’s priority list.

According to the analysis carried out by the Norwegian authorities, the annual export of Russian oil being carried along the Norwegian coast may reach the volume of 50-150 million tons in the next decade, and the size of oil transportation volumes depends on the perspective of constructing a trunk pipeline to the Barents Sea coast. What we see now, is that the possible Northern pipeline would not play a major role in determining the oil volumes shipped in the Barents Sea.

In the present report on oil transportation from the Russian North, we have given special attention to the description of the existing and prospective offshore and onshore oil shipment terminals, and their connection to the oil reserves on one hand and to the export routes on the other. In this report we demonstrate that even without a trunk oil pipeline to the Barents Sea coast, the annual oil exports from the Russian part of the Barents Region may reach a volume of about 50-80 million tons in the next decade.

About 50 million tons of crude oil and oil products can be delivered by railway to the Murmansk ports in the Barents Sea, and Kandalaksha and Arkhangelsk in the White Sea. In addition, up to 20 million tons of oil will come from the northern oil fields in the Nenets Autonomous Region, and from Prirazlomnoye oil field in the Pechora Sea. Prirazlomnoye is the first offshore industrial oil field in the Russian part of the Barents Region, the operations there will go on all year round, and most of the year in ice-covered waters. Dolginskoye oil field, which is also in the Pechora Sea and estimated to be three times as big as Prirazlomnoye, can produce the first oil in 2013.

There will be stable increase in the amounts of oil shipped from Western Siberia. The terminals in the Kara Sea can load 2-3 million tons of crude oil for transshipment in the Kola Bay of the Barents Sea.

Oil pollution prevention should be the central issue during oil transportation in the Barents Sea. In this report we pay attention to the environmental safety matters in oil transportation and Norwegian-Russian co-operation in the oil pollution prevention. The increasing internationalisation of the transport system in the region appears to affect the present trend toward more advanced and safer terminals and vessels that comply with international safety rules. Early warning and notification of ships passing through the Norwegian waters has been used more frequently and on voluntary basis, but still not as often as desired and can be arranged within a bilateral Russian-Norwegian agreement. The establishment of traffic cntrol centres in Vardø and Murmansk will considerably improve the oil spill prevention and response preparedness.

.. Oil production plans

According to estimates by the Administration of the Nenets Autonomous Region the annual oil production on the territory of the Nenets region in 2010 will be on the level of 25 million tons, and in the period of 2010-2020 can reach and be stabilised on the level of 30 million tons. The growth in production will be provided by newly developed and discovered fields.

In 2010-2020, Timano-Pechora oil-and-gas province can give the stable annual production of 40-45 million tons of oil.

.. Oil production prospects

The oil extraction on the shelf of the Barents Sea will begin with the start of operations at Prirazlomnoye oil field. Prirazlomnoye oil field is one of the largest among the proven oil reserves in the Russian western Arctic shelf. Discovered in 1989, the Prirazlomnoye oil field is located in the Pechora Sea, about 60 kilometres north of the Nenets Autonomous Region coast, with the sea depth of 19 metres.

The cumulative oil production for the operation period of 23 years should amount to 75 million tons. Since 2002 the license for the development of Prirazlomnoye oil field belongs to the Sevmorneftegaz Company. Sevmorneftegas was founded by Gazprom and Rosneft in 2002, and in 2005 the Company became 100% subsidiary of Gazprom.

The platform Prirazlomnaya, that is built in Severodvinsk, Arkhangelsk Region, should be completed and delivered to the field in the Pechora Sea in 2007. The yearly production maximum of about 7 million tons of oil can be reached in the fifth year of development. Oil from Prirazlomnoye will be delivered by tankers to Rotterdam.

The major part in the future oil shipment in the Pechora Sea is linked to the production at Dolginskoye oil field. The licence for oil exploration and production at this field was given to Gazprom in December 2005. Dolginskoye field with proven reserves of 235 million tons of oil is located north of Prirazlomnoye. It is the largest among discovered oil fields in the Pechora Sea.

From 2007 to 2009, Gazflot, subsidiary of Gazprom, plans to drill 7 new exploration wells at Dolginskoye, and get the first oil in 2015.

Oil production is planned on three more licensed sites in the Pechora Sea – Medynsko- Varandeyskiy area, Kolokolmorskiy and Pomorskiy blocks. The licenses are owned by Arktikshelfneftegaz, and the oil fields can be put in operation after 2010. The estimated recoverable Figure 3.12 Prirazlomnoye oil field is one of the largest among the proven oil reserves in the Russian western Arctic shelf.

Ministry of Industry and Energy of Russia reported to the Russian Duma in 2007 that the annual oil production on the whole Russian continental shelf is estimated to be on the level of 110 million tons in 2030.

Gas production prospects

The region’s biggest hope is the Shtokman gas field in the Barents Sea shelf. The Shtokman project has been prioritised by the authorities and companies, as well as highlighted in media during the last five years. The Shtokman project development has several sides and challenges – economical, tec

hnological, environmental and political.

Discovered in 1988, the Shtokman gas and condensate field is located in the central part of the Barents Sea, about 600 kilometres north-east of the city of Murmansk, with local sea depths varying from 320 to 340 metres.

Shtokman’s explored reserves are valued at not less than 3.7 trillion cubic metres of gas and more than 31 million tons of gas condensate.

The Shtokman project contemplates extracting some 70 billion cubic metres of natural gas and 0.6 million tons of gas condensate annually. This is commensurate with annual gas production in Norway, which is a large gas supplier to Europe.

An initial project stage is expected to see annual production levels of 22.5 billion cubic metres of natural gas and 205 thousand tons of gas condensate.

In 2006, Gazprom completed drilling an appraisal well #7 in the field. A preliminary analysis of the results enables to anticipation of a further increase in Shtokman’s production potential.

Strong assistance to the project execution is scheduled to be received from the Murmansk Region Administration and the Russian Federation Navy based on the Cooperation Agreements with Gazprom dated November 2005. About 20 Russian companies are planned to be invited as contractors for constructing port berths, engineering pipelines and giving environmental impact assessments.

Historians and archaeologists will be invited for performing cultural and historical studies of the territories concerned.

It is planned that gas will be transported from the Shtokman field to an LNG plant to be built in Vidyaevo in the Murmansk Region, and by the pipeline Teriberka-Medvezhyegorsk-Volkhov to the Nord Stream gas pipeline.

The prime area for exploration and development of gas reserves is the Arctic shelf consisting of the Northeast shelf of the Barents Sea, the shallow part of the Pechora Sea shelf, the Priyamal shelf of the Kara Sea, the Ob and Tazov Bays.

According to Gazprom estimates, the gas reserves in the region (excluding Shtokman gas field) can provide the total production of 10 billion cubic metres of gas and 300 thousand tons of gas condensate by the year 2020.

Ministry of Industry and Energy of Russia reported in 2007 that the annual natural gas production on the Russian continental shelf is estimated to be on the level of 160 billion cubic metres in 2030.

Oil and Gas Transport

The volume of crude oil export in 2015 may reach an estimated 272-300 million tons (versus 249 million tons in 2006).

Export is expected to grow due to the increase of oil supplies to the countries of the “far abroad” while oil export to the CIS countries will be little changed.

The growth of primary oil processing is expected to reach 225-230 million tons by 2015. The production of petrol will increase by 1.2-1.3 times, and of diesel fuel by 17-23%. Export of oil products will remain stable.

Given the expected rate for growth of the world market of oil and oil products, the targets set by the Energy Strategy of Russia for diversifying export transports and an insignificant increase in the volume of transit, the Ministry of Industry and Energy expects that the volume of oil supplies to the European market will remain stable (235 million tons).

Oil shipments to the Asia Pacific countries will increase to 80 million tons and to the United States to 12 million tons. This would assure for Russian exported oil a share of over 20% in the end consumption in Europe, more than 5% in the China, and about 1% in the USA.

By 2015, gas production is variously predicted to increase to 742-754 billion cubic metres (versus 638 billion cubic metres in 2005). The bulk of the growth is expected in the North Western region, by 38 billion cubic metres due to the development of the Shtokman field.

The target is to fully meet the internal gas needs of the economy and the household while consumption is to increase from 442 billion cubic metres in 2005 to 470 billion cubic metres in 2010 and 490 billion cubic metres in 2015.

Gas export in 2015 may reach an estimated 274- 281 billion cubic metres (versus 207 billion cubic metres in 2005). Given the trends in the development of the world gas market and Russia’s possible place in that market and the strategic decision to diversify export shipments, the structure of Russian gas export will be fundamentally changed:

• due to the development of resources in the Eastern part of Russia (Sakhalin-1 and -2) and the Shtokman field the share of liquefied natural gas delivered to the APR markets and to the East coast of the USA will reach 61 billion cubic metres (22% of the total exports);

• 30 billion cubic metres will be shipped (11%) along the western route to China (Altai project);

• gas supplies to Europe will grow from 154 to 173 billion cubic metres (its share in total exports will drop by 12% to 62%), while the routes of gas supply will be diversified via Nord Stream, and the Blue Stream will be extended to countries of Central Europe and southern regions of Italy;

• supplies of Russian gas to the countries of the former USSR will be balanced out (gradually replaced) by supplies of the Central Asian gas . As a result the export of Russian gas to this region will drop by 37 billion cubic metres and its share in total exports by 20% to 6%.

The development of production and export of oil and gas calls for a matching development of the infrastructure of the pipelines for the transportation of hydrocarbons and products of their processing.

Sea transportation

The first seaport of Russia, Arkhangelsk, celebrated its 420th year anniversary in 2004. Today, the backbone of sea transportation in Russia is comprised of 44 commercial seaports, 146 private wharfs, 10 large state and corporate sea shipping companies and about 300 private sea shipping operators.

The freight turnover of the Russian seaports has grown steadily during the recent seven years. In 1999, the yearly turnover was 162 million tons; in 2003, it was 285 million tons; and in 2006 it reached the level of 421 million tons. Oil and petroleum products form up to 50% of the sea cargo.

The seaports of the Northwest region take the leading position in the ports freight turnover. In 2005, the North-western seaports transhipped 178.4 million tons of cargo (or 44% of 406.9 million tons of the Russian seaports freight turnover), including 106.7 million tons of bulk cargo – mostly oil and oil products; the Southern basin ports transhipped 159 million tons (39%) with 112 million tons of bulk; and the Far-East region ports transhipped 69.5 million tons (17%), including 14.9 million tons of bulk cargo.

After the fall of the USSR, the sea transportation capability for international trade and internal transportation sharply deteriorated and the development of the Northern Sea Route was given a greater priority. In particular, this concerned the development of the seaports in the Russian part of the Barents Region. In 1990, about 7 million tons of cargo was transported by the Northern Sea Route, while in 2002 the transportation volume was only 1.5 million tons, and in 2005 – 1.8 million tons.

According to the Federal Agency of Sea and River Transports of Russia, the annual freight turnover by the Northern Sea Route should increase to 12 million tons in 2010; 28 million tons in 2015; and reach 50 million tons in 2020.

In the “Strategy of transport development in the Russian Federation for the period to 2010”, the great emphasis is given to the increase of seaports’ capabilities. According to the Ministry of Transport, by the year 2010, the volumes of cargo passing through the Russian seaports should increase to 540 million tons a year, and the share of domestic seaports in processing the Russian and transit cargoes should reach 90%. The tonnage of the Russian controlled fleet sh

ould increase to 16.8 million tons, the transit transportations through the Russian territory are to reach 80 million tons per year.

There should appear a number of modern multimodal logistics centres. The projected modernisation of the Arctic transportation system should ensure Russia’s strategic control of the Russian Arctic regions, establish steady export along the northern sea communications, as well as promote the development of natural resources in the northern territories. In order to implement these plans, Russia is building nuclear icebreaking and tanker fleets of a new generation.

In 2006, the Russian Arctic icebreaking fleet operated by Murmansk Shipping Company (MSC) and Far-East Shipping Company (FESCO) consisted of 12 ice-breakers including 7 nuclear ones built in the period from 1974 to 1992 – Arktika, Sibir, Rossiya, Taimyr, Sovetskiy Soyuz, Vaigach, and Yamal.

In January 2007, the construction of the biggest in the world nuclear icebreaker named 50 Let Pobedy (50 Year Anniversary of the Victory) was completed. Construction started in October 1989 at Baltic Works in St. Petersburg. Work was halted in 1993, and construction was restarted in 2003. The icebreaker is an upgrade of the Arktika-class: the 159-meter long and 30-meter wide vessel, with deadweight of 25 000 tons, is designed to break through ice up to 2.8 metres thick.

In 2004, the total tanker fleet of Russian companies as Sovkomflot, Novoship, Lukoil- Arctic-Tanker, Primorsk Shipping Corporation and Murmansk Shipping Company consisted of 155 vessels with the total deadweight more than 8 million tons. By the year 2008, new ships are to be built with the total tonnage of 3.4 million tons.

Sovcomflot, the countries largest marine shipper, is actively expanding its business in the Russian Arctic. The Company runs Far East and Arctic marine hydrocarbon transport and servicing projects, such as Sakhalin-1, Sakhalin-2, Varandey and Prirazlomnoye.

In January 2007, Rosneft and the Sovcomflot group of companies reached agreements on the formation of a joint company to service Rosneft’s shelf projects. The new company will be formed on the basis of Rosnefteflot (a Rosneft subsidiary), that operates FSO Belokamenka. The Sovcomflot group of companies owns a fleet of 56 vessels (43 tankers) with a total deadweight of 4.3 million tonnes. The company specialises in marine transport of energy resources. Of its total fleet, 47 vessels are tankers and gas carriers with a total deadweight of 4.2 million tonnes. Each tanker has a double hull, and the average age of the oil-loading fleet is less than five years – one of the best in the international shipping industry.

By 2008, Sovcomflot intends to become the world leader in shuttle movements of hydrocarbons in icy conditions. For the period from 2007 to 2010, Sovkomflot plans to receive 19 new tankers and gas carriers with the total deadweight of 1.6 million tons.

Development of the ports capacities in the Russian part of the Barents Region is directly connected to the increase of hydrocarbon exports. In 2006, the seaports of Varandey, Arkhangelsk, Vitino and Murmansk, directly or through the offshore terminals in the Kola Bay, exported about 10 million tons of oil (in 2002 it was 4 million tons; and in 2004, the amount was almost 12 million tons).

By 2010, the volume of oil exported to the western market through the Barents Sea can grow up to 40 million tons, and by 2015, it can reach 100 million tons a year.

Russian LNG export perspectives

In December 2005, Russian Government adopted a decision to cancel export duties on liquefied natural gas (LNG). According to the Ministry of Economical Development and Trade, this decision should create attractive terms for investment in LNG plants and would help to enter new markets.

In April 2006, Gazprom Marketing & Trading Company, a subsidiary of Gazprom registered in Great Britain, stated that the Russian gas monopolist Gazprom intended to join forces with the key players on the market of LNG for operations on the North American LNG market.

Gazprom intended to participate in all stages of this work, from the production of natural gas to its liquefaction and transportation and re-gasification. Gazprom also planned to win 10% of the United States’ gas market by 2010 and subsequently to double its share. There is no global market for natural gas so far due to high transportation outlays, depending on the distance. Besides, producers and consumers are tightly linked to each other by the policy of agreements and pipelines. As of now, Gazprom depends to a large extent on the existence of pipelines and on the attitudes of transit countries.

LNG is an alternative to pipeline gas transportation and is winning a growing share of the market. According to the Institute for International Economic and Political Studies of the Russian Academy of Sciences, in 2004, LNG share in the volume of global natural gas exports was more than 25%. In 2006, it accounted for about 6% of the global consumption of natural gas. The International Energy Agency has calculated that LNG's share of the market will grow to 16% by 2030.

The main projects for the creation of LNG production facilities in Russia are connected with the possible deliveries of LNG to the USA and East Asia, where Russian natural gas could not be delivered by pipeline in the foreseeable future.

Gazprom plans to produce LNG for future deliveries to the North American market at the Shtokman field in the Barents Sea and Kharasaveiskoye field on the Kara Sea coast in Yamal. An independent LNG producer Novatek is also working on the Yamal peninsula. Another liquefaction plant is slated to be built in the Leningrad Region in cooperation with Petro- Canada. SG-Trans Company, the biggest liquefied gas transport operator in Russia, plans to build a terminal for 0.6 million tons of LNG there.

According to Shtokman development plans, gas is to be delivered to the LNG plant that should be built in Vidyaevo on the Barents Sea coast. The planned capacity of the LNG facility there is about 20 million tons annually. The major part of Shtokman LNG supposed to be sold in the USA and Canada.

In December 2005, Sovcomflot Group signed an agreement with Gazprom to collaborate in the projects for shipping oil and gas. The agreement, in particular, was aimed at developing cooperation between Gazprom and Sovcomflot in the LNG sector.

Four more LNG tankers are under construction for Sovcomflot. «Grand Elena» (Se egen artikkel “Nyutviklinger fra Japans skipsbygningsindustri” i dette nummer av SR) and «Grand Aniva» for 145 000 cubic metres each will be delivered by Mitsubishi Heavy Industries in 2007; another two for 145 700 cubic metres each are built at Daewoo Shipbuilding and Marine Engineering Company and should be delivered in 2008.

In 2006, the Russian State Duma approved and the President signed a law “On Gas Export” which gave the exclusive right to export gas to an operator that owns the unified gas supply system or to its 100% subsidiary. The law formalised Gazprom’s monopoly over pipeline gas exports and also extended the company's export monopoly to LNG, and liquefied petroleum gas (LPG). The sole exception to the new law allows non-Gazprom gas exports from companies that hold production sharing agreements (PSA) with the Russian Government.

Oil transportation routes in the Barents region

In 2002, 4 million tons of Russian oil was exported along the Norwegian coastline, in 2003 the amount doubled to 8 million tons, in 2004 it almost reached 12 million tons, in 2005 dropped to 9.5 million tons, and in 2006 rose to more than 10 million tons. Already in 2010, Russia may have the capacity to export up to 80 million tons of oil that way, and in 2015 the total capacity of the Arctic oil terminals can be over 100 million tons.

The coastal and offshore te

rminals are sending oil for export directly or via offshore transhipment terminals in the Kola Bay and even via terminals constructed in the northern Norway. These transhipment terminals are not listed in the table.

It is not guaranteed that the above oil volumes will be shipped through the Barents Sea in three years perspective. But when the nearest plans of state and private companies to construct and expand pipelines, railroads, ports, and terminals are implemented, Russia will have transportation facilities to export 80 million tons of oil by northern routes; and in 2015 this capacity may be increased to 150 million tons.

The private oil companies are motivated to export as much oil as possible. In 2002, the big oil companies proposed to build a trunk oil pipeline from the Western Siberia to Murmansk with the capacity of 120 million tons. Having the Baltic Pipeline System and Eastern Siberia–Pacific Ocean pipeline in the top of the priority list, the trunk oil pipeline monopolist Transneft have reconsidered the Murmansk pipeline proposal and elaborated the Northern project – building the Kharyaga-Indiga pipeline with the capacity of 12 million tons. In the meantime the oil companies, state and private, are going for oil transport by railway to the ports of the White and the Barents seas.

With modernisation of the Russian railway system going on in the north, rail alone can bring up to 50 million tons of oil for export in 2010. Besides, up to 20 million tons of oil will come from fields in the northern parts of the Nenets Autonomous Region and the Pechora Sea. About 3 million tons of oil may be shipped via terminals in the Kara Sea to be transhipped in the ice-free area of the Barents Sea.

By 2015, new terminals can be built in the Kola and the Pechenga bays of the Barents Sea. The Dikson port will be a perspectives transhipment site when new oil and gas fields in Taymyr and the Kara Sea are developed. And Gazprom intends to build LNG plants in Yamal and Kola Peninsula.

It is seen from the above that even without the trunk pipeline to Murmansk the shipments of oil and gas from Russia passing the northern Norway will be significantly increased.

The Barents Sea, Norway

Since the oil transportation from the Russian Barents Region started growing in 2002, there were visions and suggestions about the establishment of a transhipment terminal for Russian oil in the Norwegian County Finnmark.

There were proposals to build such terminals in places such as Vardø, Paddeby, and Bøkfjord outside Kirkenes. The formal requests for getting permits to establish oil transhipment terminals near Kirkenes were sent by ShipCargo Ltd and Bergesen d.y. ASA. The ship owner Bergesen d.y. ASA planned to anchor the old Berge Enterprise super tanker and use it as a Floating Storage and Offloading vessel (FSO) oil transfer terminal. This is a similar solution that Bergesen Company has with the ship Belokamenka (before Berge Pioneer) in the Kola Bay near Murmansk.

The anchored storage ship in Bøkfjord was considered as a permanent installation. The prospects to establish a terminal in Bøkfjord were based on the future increase in oil to be shipped from the Russian part of the Barents Region ports, and on the belief that the Russian side has not enough oil reloading facilities.

In May 2002, there was an oil transhipment operation in Bøkfjord run by ShipCargo. Three Lukoil tankers of Astrakhan type completed ship- to-ship (STS) loading of 15 000 tons of crude oil each into a 46 500 tons deadweight Greek tanker Shinoussa of Eletson Corporation. With this operation the entire process concerning transhipment in Northern Norway was started. In 2005, ShipCargo received a permit for STS from the Norwegian Coastal Administration, but would need permission from more governmental gencies to be able to start operations.

Also in 2005, a temporary permission for oil loading in the Ropelv near Kirkenes was given to Kirkenes Transit, and was annulled in 2006 when the authorities banned oil shipping activities in a salmon protected area. The company Kirkenes Transit got a permit to carry out oil loading in the Sarnesfjorden, further west and close to the North Cape. The company accomplished nine loadings in the winter of 2005-2006 in Bøkfjord, 55 000 tons of gas condensate each.

The Norwegian Pollution Control Authority gives concession to Kirkenes Transit for loading of Russian gas condensate at three suggested sites in the North Cape municipality. Concession is granted on certain conditions. Conditions are connected to handling of oil vapour (NMVOC), ballast water and noise. Further requirements include measures for preventing acute pollution and emergency response system. Tschudi Shipping, the owner of Kirkenes Transit, is negotiating with a Russian oil company a possibility of signing a long term contract for crude oil loading.

The petroleum company ENI is also considering to pipe oil from the Goliat field in the Barents Sea to Sarnesfjord for further shipping oil to the markets.

Rapporten har videre egen seksjon om

Environmental Safety

med undergrupper: environmental requirements for oil transhipment, oil transportation monitoring and emergency response system, oil transportation from northwest Russia and Norwegian coast emergency response system, Vardø vessel traffic centre, new routing for tankers in Norway, Norwegian–Russian cooperation in oil pollution abatement and maritime safety og accidental oil pollution.

Oil pollution and response in the Russian Barents region

Vessel standards

The fleet of ships carrying oil from the Northwest Russia is new. 100 out of 132 vessels passed in 2006 were built in the years 2000-2006. Almost all vessels carrying oil from harbours in Northwest Russia have a double hull. In 2006, there was one ship registered with a single hull. Six vessels were listed as vessels with an unspecified hull type.

Summary and conclusions

Oil traffic from Northwest Russia is on the serious rise, especially in the amount of transported oil. There is a growing number of countries that get oil from Northwest Russia and a growing number of countries that send their ships to transport oil from there. That shows that oil shipping from this area is getting a more important international status. The weak link today is the infrastructure that hinders the oil flow to the export harbours.

When this problem is solved, it will be more cost effective to use even larger size tankers than it is for now and the long expected traffic to USA will become reality.

The vessels used in the traffic are mostly new and generally advanced in shipping technology. Various sea accidents in the last few years have resulted in revision of international requirements for sea vessel standards and these regulations seem to have been implemented by major actors in oil transportation from Northwest Russia.

New routing for tankers in Norway

Norway has developed a new mandatory traffic separation scheme. The loaded tankers from the North of Russia will from July 2007 follow the new route between Vardø and Røst that mainly lies within 30 nautical miles outside the Norwegian coast. International Maritime Organisation (IMO) rarely accepts routes for such connected areas as Vardø-Røst. The Norwegian Ministry of Fisheries and Coastal Affairs’ dialog with delegations of other countries prior to the approval, especially with Russia, has been very important for getting support for the proposal.

(Kilde: “Oil transport from the Russian part of the Barents Region Status per January 2007”. The authors, Alexei Bambulyak and Bjørn Frantzen, have been working for more than 10 years on environmental cooperation in the Barents Euro-Arctic Region with special emphasis on Russia. Fr

antzen lead the Norwegian Polar Institute in Svalbard, and Bambulyak was a project manager at the Karelian Information Barents Centre. From 1997 to 2005, both worked at Svanhovd Environmental Centre, they lead the Barents Council Environmental Management Program for the Murmansk Region (EMP-Murmansk), and facilitated environmental capacity building projects in Northwest Russia. Today, Alexei Bambulyak has his daily work at Akvaplan-niva as General Manager Russia, and Bjørn Frantzen works as Project Manager at Bioforsk – Soil and Environment, Svanhovd. Both are responsible for arranging cooperation between their companies and Russian environmental institutes under the Barents and bilateral Norwegian-Russian agreements. Authors and their companies have for many years closely collaborated with the Norwegian Barents Secretariat and been focused on the environmental aspect related to development of oil-and-gas industry in the Arctic regions. Frantzen and Bambulyak have personally visited many of the sites described in this report, had meetings with environmental authorities, petroleum and transport companies working in the region. The present work also describes their experience undertaken in this sphere.)